ZeppoTrade offers the simplest way to connect alerts without the need for TradingView Pro, ensuring your trading experience is effortless and highly efficient.

Before we dive into the specifics of connecting TradingView alerts to Bybit, you need to connect TradingView to ZeppoTrade. This crucial step ensures that your alerts reach Bybit seamlessly. Don't worry; we have a separate article explaining how to do just that.

How to connect TradingView To ZeppoTrade.When it comes to automating your cryptocurrency trading, ZeppoTrade stands out as a game-changer. But how exactly does it work, and what sets it apart from the rest?

ZeppoTrade seamlessly integrates with TradingView, the popular charting and analysis platform used by traders worldwide. Here's where the magic begins: you create your trading alerts on TradingView just like you normally would.

Now, here's the key difference: ZeppoTrade allows you to automate these TradingView alerts to execute on Bybit. ZeppoTrade offers multiple plans, making it suitable for traders with varying needs. This versatility is a game-changer for traders looking to capitalize on market opportunities swiftly and efficiently.

ZeppoTrade connects directly to Bybit, one of the leading cryptocurrency exchanges globally. When your TradingView alert is triggered, ZeppoTrade takes care of the rest. It sends your trading instructions directly to Bybit for execution.

Here's what makes ZeppoTrade truly unique: it doesn't rely on webhooks to receive alerts. Unlike other solutions that may require complex webhook setups, ZeppoTrade simplifies the process. This means you don't have to deal with the technicalities of configuring webhooks, making it accessible and hassle-free for traders of all levels. So, in a nutshell, ZeppoTrade streamlines the entire process of automating your TradingView alerts to Bybit. It's user-friendly, cost-effective, and, most importantly, it doesn't burden you with webhook configurations. This means you can focus on what matters most—making informed trading decisions and maximizing your profits in the fast-paced world of cryptocurrency trading.

symbol - trading pair you want to trade (BTCUSDT, ETHUSDT).

account - account you want to use to execute the trade. Valid options are: SPOT and FUTURES

quantity - quantity or amount of the asset you want to trade.

buyquantity - quantity when side is buy

sellquantity - quantity when side is sell

side - parameter indicates whether you want to place a buy order or a sell order. Valid options are BUY/LONG and SELL/SHORT

price - The specified price at which your LIMIT order is set. If not provided, the order will be treated as a MARKET order.

usdquantity - Quantity in usd. This is ONLY available in SPOT when BUYING.

accounttype - Account type. UNIFIED (trade spot/linear/options), CONTRACT(trade inverse). Default is UNIFIED

wait - set delay before execution of your trade. It is specified in seconds. For example, if you set wait=10, it means that the system will pause for 10 seconds before executing the trade.

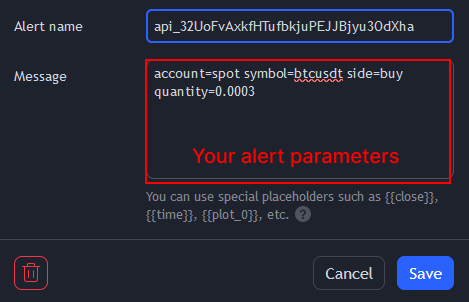

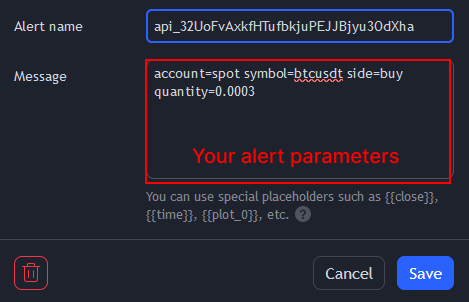

Every alert parameter goes inside Tradingview message.

Every parameter needs to be seperated using one "=" without spaces. Parameters are NOT case-sensitive.

account = spot symbol= BTCUSDT side==buy quantity= 0.003

account=spot symbol=BTCUSDT side=buy quantity=0.003

Buy 0.0003 BTC at fixed price (limit order)

account=spot symbol=btcusdt side=buy quantity=0.0003 price=60000

Buy 0.0003 BTC at market price

account=spot symbol=btcusdt side=buy quantity=0.0003

Buy BTC with $100 at market price.

symbol=btcusdt account=spot side=buy usdquantity=100

Buy BTC by using 25% of account balance at market price.

symbol=btcusdt account=spot side=buy quantity=25%

Sell 0.0003 BTC at fixed price (limit order)

account=spot symbol=btcusdt side=sell quantity=0.0003 price=60000

Sell 0.0003 BTC at market price

symbol=btcusdt account=spot side=sell quantity=0.0003

Sell 50% of BTC balance at market price.

account=spot symbol=btcusdt side=sell quantity=50%

Sell $100 of BTC at market price.

symbol=btcusdt account=spot side=buy quantity=100/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 100 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be sold with 100 USDT.

Buy 0.0003 BTC, Sell 100% (market order)

account=spot symbol=btcusdt side={{strategy.order.action}} sellquantity=100% buyquantity=0.0003

Buy using 50% of account balance, Sell 100% (market order)

account=spot symbol=btcusdt side={{strategy.order.action}} sellquantity=100% buyquantity=50%

Allowed Operations:

Addition +

Subtraction -

Multiplication *

Division /

Place Buy order below the current BTC price by 100 USDT

account=spot symbol=btcusdt side=buy quantity=50% price={{close}}-100

Place Buy order at market price with 100 USDT.

account=spot symbol=btcusdt side=buy quantity=100/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 100 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be purchased with 100 USDT.

Set delay before execution of your trade. It is specified in seconds. For example, if you set wait=10,

it means that the system will pause for 10 seconds before executing the trade.

Delay 10 seconds before buying BTC

wait=10 account=spot symbol=btcusdt side=buy quantity=50%

You can read more about tradingview placeholders here.

account=spot symbol=btcusdt side={{strategy.order.action}} quantity={{strategy.market_position_size}}

{{strategy.order.action}} - returns the string “buy” or “sell” for the executed order.

{{strategy.market_position_size}} - returns the size of the current position.

symbol - trading pair you want to trade (BTCUSDT, ETHUSDT).

account - account you want to use to execute the trade. Valid options are: SPOT and FUTURES

quantity - quantity of the asset you want to trade.

buyquantity - quantity when side is buy

sellquantity - quantity when side is sell

side - parameter indicates whether you want to place a buy order or a sell order. Valid options are BUY/LONG and SELL/SHORT

price - The specified price at which your LIMIT order is set. If not provided, the order will be treated as a MARKET order.

tp - takeprofit order at specified price

sl - stoploss order at specified price

margin - type of margin. Valid options are: CROSS and ISOLATED.

leverage - if not provided default leverage is 10X.

cancel - Close existing postion. Symbol must be provided.

accounttype - Account type. UNIFIED (trade spot/linear/options), CONTRACT(trade inverse). Default is UNIFIED

wait - set delay before execution of your trade. It is specified in seconds. For example, if you set wait=10, it means that the system will pause for 10 seconds before executing the trade.

retracement - Used for opening trailing stop. It can be in number (usd) or %

activationprice - Not required when opening trailing stop. If not provided it will use current market price.

Every alert parameter goes inside Tradingview message.

Alert must contain every required paramater in order to execute.

Every paramater needs to be seperated using one "=" without spaces.

account = futures symbol= BTCUSDT side==buy quantity= 0.003

account=futures symbol=BTCUSDT side=buy quantity=0.003

Long 0.003 BTC at fixed price (limit order)

account=futures symbol=btcusdt side=long quantity=0.003 price=60000

Long 0.003 BTC at market price

account=futures symbol=btcusdt side=long quantity=0.003

Long BTC by using 25% of account balance at market price.

account=futures symbol=btcusdt side=long quantity=25%

Long BTC at market price using 200 USDT.

account=futures symbol=btcusdt side=buy quantity=200/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 200 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be purchased with 200 USDT.

Short 0.003 BTC at fixed price (limit order)

account=futures symbol=btcusdt side=short quantity=0.003 price=60000

Short 0.003 BTC at market price

account=futures symbol=btcusdt side=short quantity=0.003

Short BTC by using 50% of account balance at market price.

account=futures symbol=btcusdt side=short quantity=50%

Short BTC at market price using 200 USDT.

account=futures symbol=btcusdt side=sell quantity=200/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 200 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be purchased with 200 USDT.

Long 0.003 BTC, Close full position (100%)

account=futures symbol=btcusdt side={{strategy.order.action}} sellquantity=100% buyquantity=0.0003

Long 10% of account balance, Close full position (100%)

account=futures symbol=btcusdt side={{strategy.order.action}} sellquantity=100% buyquantity=10%

Close BTC position completely

cancel=BTCUSDT

Closing previous position and opening a new one

cancel=btcusdt account=futures symbol=btcusdt side=long quantity=30%

Long 0.003 BTC at market price, 15x leverage

account=futures symbol=btcusdt side=long quantity=0.003 leverage=15

Short 0.003 BTC at market price, 20x leverage

account=futures symbol=btcusdt side=short quantity=0.003 leverage=20

Long 0.003 BTC at market price, set Stoploss to $5000

account=futures symbol=btcusdt side=long quantity=0.003 sl=5000

Long 0.003 BTC at market price, set Takeprofit to $80000

account=futures symbol=btcusdt side=short quantity=0.003 tp=80000

Long 0.003 BTC at market price, set Takeprofit to $80000, set Stoploss to $5000

account=futures symbol=btcusdt side=short quantity=0.003 tp=80000 sl=5000

Long 0.003 BTC at market price, set Stoploss to 5% from current price.

account=futures symbol=btcusdt side=long quantity=0.003 sl=5%

Long 0.003 BTC at market price, set Takeprofit to 5% from current price.

account=futures symbol=btcusdt side=buy quantity=0.003 tp=5%

Edit Takeprofit on existing BTC position.

symbol=BTCUSDT tp=75000

Edit Takeprofit on existing BTC position.

symbol=BTCUSDT tp=25%

Edit Stoploss on existing BTC position.

symbol=BTCUSDT sl=6000

Edit Stoploss on existing BTC position.

symbol=BTCUSDT sl=25%

Edit Takeprofit and Stoploss on existing BTC position.

symbol=BTCUSDT tp=75000 sl=4500

Cancel Stoploss or Takeprofit on existing BTC position.

symbol=BTCUSDT tp=cancel sl=cancel

The order will be triggered with last price immediately. If the price increases by 1% from the lowest price, the position will close.

symbol=btcusdt retracement=1%

The order will be triggered with last price immediately. If the price increases by $1000 from the lowest price, the position will close.

symbol=btcusdt retracement=1000

When the price reaches $70000 the order will be activated. If the price increases by 1% from the lowest price, the position will close

symbol=btcusdt retracement=1000 activationprice=70000

Opening Long 0.003 BTC at market price with trailing stop. When the price reaches $70000 the order will be activated. If the price increases by $5000 from the lowest price, the position will close

symbol=btcusdt side=buy quantity=0.003 account=futures retracement=5000

You can choose between two margin modes: cross margin and isolated margin.

Read more about types of margin here

Long 0.003 BTC at market price, cross margin

account=futures symbol=btcusdt side=long quantity=0.003 margin=cross

Short 0.003 BTC at market price, isolated margin

account=futures symbol=btcusdt side=short quantity=0.003 margin=isolated

Allowed Operations:

Addition +

Subtraction -

Multiplication *

Division /

Set takeprofit $1000 above from current bitcoin price.

account=futures symbol=btcusdt side=buy quantity=100% tp={{close}}+1000

Long BTC at market price using 200 USDT.

account=futures symbol=btcusdt side=buy quantity=200/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 200 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be purchased with 200 USDT.

Short BTC at market price using 200 USDT.

account=futures symbol=btcusdt side=sell quantity=200/{{close}}

{{close}} is tradingview placeholder which will return current Bitcoin price.

Dividing 200 by the current price {{close}} calculates the quantity of Bitcoin (BTC) that can be purchased with 200 USDT.

Set delay before execution of your trade. It is specified in seconds. For example, if you set wait=10,

it means that the system will pause for 10 seconds before executing the trade.

Delay 10 seconds before buying BTC

wait=10 account=futures symbol=btcusdt side=buy quantity=50%

You can read more about tradingview placeholders here.

account=futures symbol=btcusdt side={{strategy.order.action}} quantity={{strategy.market_position_size}}

{{strategy.order.action}} - returns the string “buy” or “sell” for the executed order.

{{strategy.market_position_size}} - returns the size of the current position.